Paystub Generator Free vs. Excel Templates: Which Is Better?

When managing payroll for a business or for personal use, creating paystubs is an essential task. These documents provide a breakdown of employee earnings, taxes, and deductions, ensuring that both employers and employees understand how much is being paid and where the money is going. The question often arises: Should you use a paystub generator free tool or stick to Excel templates? Both options have their merits, but understanding their differences will help you decide which is the better choice for your needs.

What Is a Paystub Generator Free?

A paystub generator free is an online tool that allows you to create professional pay stubs quickly and without cost. These tools are designed to simplify the paystub creation process, often requiring only basic information like the employee’s name, hourly wage or salary, work hours, tax deductions, and any benefits. Once the details are filled in, the generator will automatically calculate the necessary deductions and create a downloadable, ready-to-use pay stub.

These tools are typically free to use for a limited number of paystubs or have basic features available without any charge. Some generators may offer more advanced features, such as customized templates, tax calculations, and multiple employee handling, for a fee.

What Are Excel Templates?

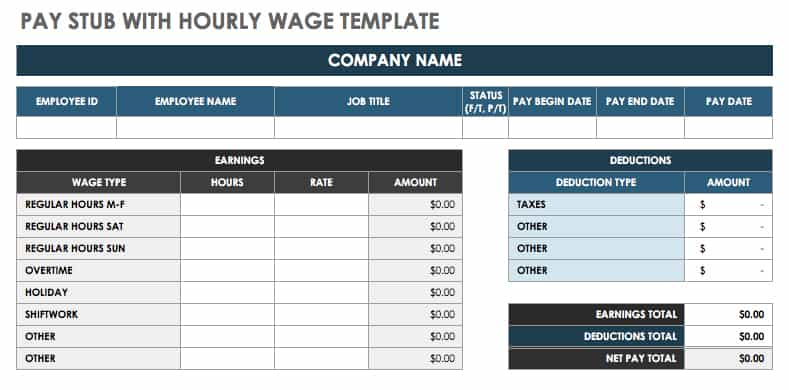

Excel templates, on the other hand, are pre-designed spreadsheets that can be customized to generate paystubs. These templates come with pre-formatted fields for employee details, wages, deductions, and other necessary information. While Excel offers more flexibility in terms of customization, it also requires a little more technical know-how than a paystub generator free tool.

Excel templates can be found online or created from scratch. They require manual input of the data, and users must ensure that the formulas and calculations are correct. Unlike paystub generators, Excel templates don’t always automatically update or provide tax-related calculations unless you set them up yourself.

Comparison: Paystub Generator Free vs. Excel Templates

1. Ease of Use

One of the most significant advantages of a paystub generator free tool is its ease of use. The interface is usually straightforward, and there’s little to no learning curve. You simply input the necessary details, and the tool does the rest. For those who don’t want to spend time designing or figuring out complex formulas, a paystub generator is the ideal solution.

On the other hand, Excel templates require you to open the software and input the data manually. While it may seem simple at first glance, users need to have a basic understanding of Excel functions, especially if they want to make modifications or corrections. If the formulas are not set up correctly, errors in calculations can easily occur, potentially leading to inaccurate pay stubs.

2. Customization

When it comes to customization, Excel templates have the upper hand. You can alter the template to fit the specific needs of your business. For instance, if you want to add additional deductions, bonuses, or benefits that aren’t typically included in a standard paystub, Excel gives you full control over the layout and calculations.

With a paystub generator free, customization options are typically more limited. While you can often change certain fields like employee names and wages, most paystub generators offer standard templates that may not cater to more complex payroll structures. However, some paid versions do allow for more in-depth customization, albeit at a cost.

3. Cost

The cost is a crucial factor in deciding between a paystub generator free and Excel templates. As the name suggests, a paystub generator free tool doesn’t require any upfront investment, making it an attractive option for small businesses or individuals who need to create pay stubs on a limited budget. However, if you require advanced features like multiple employees or custom branding, you may have to upgrade to a paid version.

Excel templates, in contrast, are generally free, especially if you download them from reputable websites. The main cost comes from the need to purchase Microsoft Excel if you don’t already have it, which can be an ongoing expense for many users. However, once you have Excel, you can create and modify as many pay stubs as needed without additional charges.

4. Accuracy

In terms of accuracy, a paystub generator free tool has the advantage. These generators are specifically designed to handle payroll calculations, so they typically account for taxes, deductions, and other necessary factors with precision. The built-in formulas ensure that your pay stubs are automatically calculated and accurate, saving you time and reducing the risk of human error.

With Excel templates, accuracy depends entirely on how well you set up your spreadsheet. If you make a mistake in a formula or forget to update a tax rate, the pay stub may not be accurate. While this gives you more control, it also puts more responsibility on the user to ensure everything is correct.

Conclusion

So, which is better: a paystub generator free or an Excel template? It depends on your specific needs. If you are looking for simplicity, speed, and accuracy with minimal effort, a paystub generator free tool is probably the better choice. It takes little to no time to set up and eliminates the risk of errors.

However, if you prefer a more customizable solution and are comfortable with Excel, templates offer more flexibility at no ongoing cost. The trade-off is that you’ll need to spend more time setting up and ensuring everything is accurate.

In summary, if you’re a small business owner or freelancer needing pay stubs quickly, a paystub generator free is a convenient solution. But if you have more complex payroll needs and want total control, Excel templates might be the way to go.