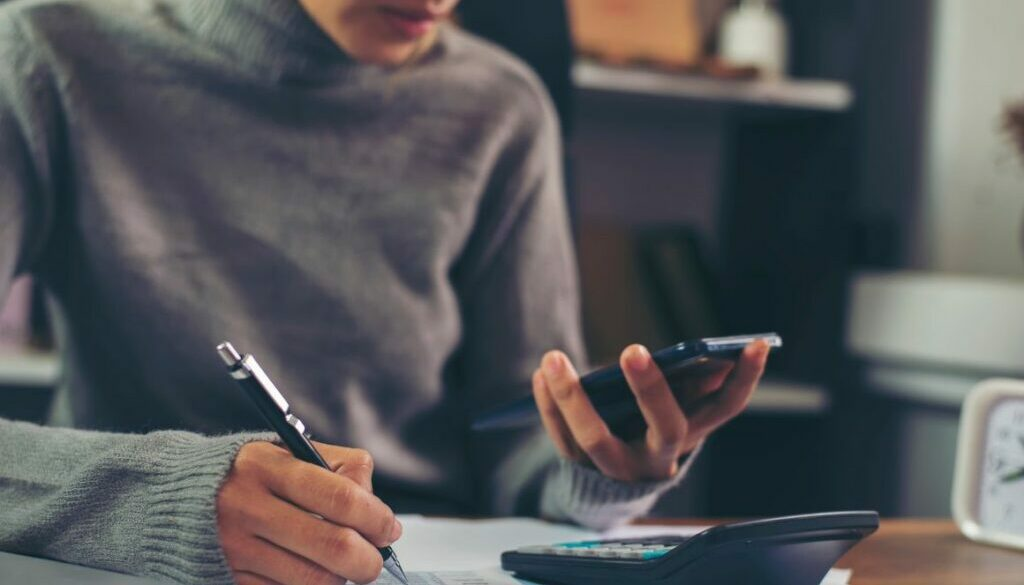

Regarding investing, the importance oftax planning cannot be overstated. Good tax planning helps you keep more of your money. It does this by reducing your tax bill and maximising your returns. However, tax laws are complex. It can be hard to make the right investments. This is where tools like the Aditya Birla Capital App come into play, helping you to simplify the process and make informed decisions.

Understanding Tax Planning for Investors

Tax planning for investors means setting up your investments to lower the tax you have to pay on your returns. It does not mean not paying your taxes; it means making smart choices that are legal and will lower your debts. Tax loss harvesting, asset location, and using tax-advantaged accounts are some of the most important strategies.

Tax-Loss Harvesting

Tax-loss harvesting is a very common way to plan your taxes. To do this, lost value investments must be sold to balance out the gains from other investments. For example, if you sold a stock that went down in value and made a big profit, you could do this to lower your taxable gains.

Asset Location

Asset location is another powerful strategy. Use accounts with different tax treatments to minimise taxes on your investment income. For example, hold tax-inefficient assets like bonds in tax-advantaged accounts (e.g., IRAs or 401(k)s). Conversely, tax-efficient investments, like certain stocks, are better suited for taxable accounts.

Long-Term Investing

Long-term investing is also a smart tax planning strategy. Investing for over a year can lower your capital gains tax, and long-term rates are better than short-term ones. This simple yet effective approach can significantly reduce your tax burden over time.

Limitations of Tax Planning

While tax planning offers significant benefits, it is important to be aware of its limitations. Tax laws are complex and constantly changing, making it difficult to stay current. Also, tax-loss harvesting requires careful record-keeping and timing. It has rules. They prevent you from repurchasing the identical security within 30 days of the sale.

Tax planning should not be the only reason for your investments. Focus on a diverse portfolio that matches your goals and risk level. Ignoring this for tax benefits can lead to poor long-term choices.

Leveraging the Aditya Birla Capital App for Smart Tax Planning

The Aditya Birla Capital App is perfect for investors who want to simplify tax planning. It offers tools to manage investments, track returns, and enhance tax efficiency. Additionally, the app provides personalised advice, making tax planning easier without needing extensive knowledge.

While smart tax planning is crucial for maximising returns, it requires a balanced approach. By leveraging tools like the Aditya Birla Capital App, you can make informed decisions that align with your financial goals while minimising your tax liabilities. Remember, the goal is to keep as much of your wealth as possible by growing your investments and protecting them from unnecessary tax burdens.